Blogs

17 July 2023

Reading Time: 10 mins

Blogs

17 July 2023

Reading Time: 10 mins

Nick Earle

Executive Chairman

LinkedInThis Talking Heads interview was originally featured in the IoT Now Magazine, Q2 2023 edition.

Although too many IoT projects still fail, a renewed focus on IoT readiness and device capabilities has the potential to accelerate success for IoT organisations. The longstanding proprietary link between mobile network operators and devices is ending with the introduction of embedded SIMs, fostering interoperability and radically simplifying IoT connectivity. This is introducing new models for IoT, not just in connectivity but in terms of how devices are designed, managed and operated. This wave of disruption will result in simplified, flexible software-as-a-service approaches to IoT enablement in which mobile network operators either retrench to become high-volume low-value providers or upskill to deliver greater value to IoT organisations. For Nick Earle, the chief executive of Eseye, it’s about time connectivity is decoupled from the operators and device capabilities are prioritised.

What is your view of the latest wave of change affecting IoT connectivity and how do you expect it to reshape the IoT sector?

The IoT and cellular markets are undergoing more disruption and change than at any time that I can recall. I’ve been in IT for more than 40 years and I’ve never seen a rate of change like this. Over my career I’ve witnessed many waves of disruption such as mainframes giving way to PCs and PCs being replaced by mobile phones. I’ve also seen the software-enabled disruption from mainframe host operating systems to client server systems to open source and web-based development. The rapid rise of artificial intelligence (AI) is the latest wave of disruption for IT. In contrast, the mobile telecoms industry has been unusual in that it has been relatively static – until recently. Just in the last 12 months we have seen Ericsson, one of the largest suppliers, exiting the platform business and Vodafone, the leader in the Gartner IoT Connectivity Magic Quadrant, spinning the business out.

What has caused this sudden disruption? The answer can be found in the triggers for the previous disruptions I mentioned in IT. In each of those cases, two things happened; there was a major leap forward in technology and interoperability was achieved.

In connectivity, the leap forward in technology is the arrival of the embedded SIM (eSIM) and integrated SIM (iSIM) that has broken the 40-year proprietary lock between the international mobile subscriber identifier (IMSI) and the mobile network operators. This is causing a significant disruption in the mobile network operator business model as it enables an uncoupling of the choice of the SIM from the choice of operator. Add to that the embedded universal integrated circuit card (eUICC) standard and new developments like the SGP.32 GSMA standard which enable over-the-air (OTA) remote SIM provisioning (RSP) of multiple operator IMSIs into a single SIM and you have the perfect disruptive storm.

Where does that leave the IoT connectivity business, and MNOs in particular?

For an enterprise, the cost of IoT data is relatively minor compared to the back-end process costs of building and maintaining multiple stock-keeping unit (SKU) numbers and gluing together multiple connectivity platforms to get a single source of truth over the IoT estate and its performance. They want to manufacture a single smart product that they can sell and activate globally and that means embedded global connectivity that just works – every time and everywhere.

Think of the alternative – without this capability you cannot test products at manufacture, you have to install plastic SIMs as you have to use different ones depending on the country or location and you have to use multiple connectivity management platforms (CMPs). These costs have hugely inhibited IoT adoption. To solve this, and create the financial incentive for IoT adoption, enterprises want the ability to have a connectivity solution that is operator-agnostic, which means using a single global eSIM or iSIM in every device, and to be able to monitor and manage their global estate from a single cloud native platform.

That’s essentially been our value proposition since 2013 when we were the first company to produce a multi-IMSI SIM card that was programmable OTA. That was long before the eUICC standard emerged, and now 95% of all SIMS we sell are eUICC eSIMs. I expect, with the introduction of iSIM, this is only going to accelerate enterprises’ appetites to integrate connectivity into their products. With iSIM, the connectivity is actually embedded into the software of the silicon and, as with an eUICC eSIM, the operator is not directly involved. This means the first time they know that a device is using their data will increasingly be when it appears on their network, they will not be involved in the sale and will not do the end-customer invoicing. In other words, the threat is that they will not own the customer.

This is a business model change that I think is as significant as the move from enterprise software licences to software-as-a-service (SaaS) in that it disrupts the financial model of the current incumbents. But with change comes opportunity and the mobile network operators (MNOs) are reacting by white labelling new global IoT platforms that sit on top of their existing ones. This enables them to undergo a managed transition from their legacy platforms to a low cost model for truly global connectivity and higher margin value-added services.

However, the consequences of eUICC and eSIM are not restricted to the need for a new global platform. Truly global connectivity necessitates firmware changes to the device and this is not a skill that MNOs necessarily have.

The promise of eUICC is that the buyer can use RSP to put different IMSIs, or profiles, from any MNO of their choice, into the device. This sounds like the holy grail for global connectivity and indeed, if you look at the marketing messages from several IoT companies, you would believe that the eSIM together with the SGP.32 standard has suddenly solved all of the previous issues. Now every device can connect to any network and every eSIM vendor is suddenly a global provider of IoT solutions.

Not surprisingly the reality is a little different. To illustrate this let me use three examples that we have seen time and time again.

Firstly, there is the potential cost of the RSP. When the IMSI changes you are localising onto a new network. This requires a localisation interconnect from the vendor to the MNO. If you are being promised the ability to localise onto, for example, six networks globally has the vendor completed these interconnects or will you have to pay for them? In our case we have built the AnyNet Federation where we can localise a SIM OTA onto sixteen different networks. That’s already in place.

Secondly, does your model support eUICC with firmware over the air (FOTA) capabilities? FOTA is needed to dynamically update the firmware so that it can work with each network. This means you have to test this in a lab environment before you deploy in each country and the standard way of doing this is the provision of a private network capability that mimics each network you want and tests the device ability to switch. Skip this step and you’ll find out the hard way why firmware optimisation is so important.

And thirdly, have you thought about the access point name (APN)? Your device may switch but the new operator will use a different APN. Does your vendor have a solution to this? As part of a managed service Eseye ensures that our single global APN can be used on all the profiles meaning that our customers get localisation without needing to reconfigure the device. This means the connection management can be dynamic and automatic.

There’s a lot to think about and we can see that this is a major issue from surveys such as Kaleido Intelligence’s Enterprise IoT study. The firm interviewed more than 800 companies who had attempted to implement an IoT project and asked them “in retrospect what was the number one difficulty that you had?” The answer wasn’t global connectivity – 84% said it was device and hardware optimisation.

We’ve talked a lot about cellular connectivity and how it will be accessed but what about the other connectivity options that form IoT connectivity?

There’s certainly a need for systems that enable the best available connectivity to be utilised and it simply isn’t good enough for many applications to address only cellular. In electric vehicles (EVs) for example, there is huge pressure to roll out charging networks. The problem is there’s no revenue model for cellular in a home EV charger. The consumer wants it for free and ideally would connect using home Wi-Fi, but Wi-Fi doesn’t penetrate walls particularly well. Wi-Fi HaLow may be the answer when it arrives to extend Wi-Fi range to 2km, but that is still some way off.

What’s needed is a multi-network EV charger that flips between cellular and Wi-Fi depending on whether the signal is available and strong enough. That involves device intelligence that is resident in the device. This time next year, we’ll be talking about smart sea containers on ships using Release 17 of the GSMA standard for switching between satellite communications at sea and cellular communications in port. There will be lots of new examples of devices that use multiple connectivity or radio access types (RATs) and this why earlier this year we launched Eseye AnyNet SMARTconnect.

AnyNet SMARTconnect is an on-device connectivity software solution that embeds intelligent, global IoT connectivity directly into any device. The software codifies Eseye’s decades of connectivity expertise into an independent plug-in software module that partners and customers can simply integrate into their IoT or connected devices. They don’t need to hire costly connectivity or firmware engineers to make this happen which allows IoT projects to scale up easily.

We think that by avoiding the traditional software development process and installing AnyNet SMARTconnect into their devices they can accelerate product launch by up to nine months. Customers and partners also benefit because AnyNet SMARTconnect supports global deployments, enabling a single SKU and includes the initial bootstrap and provisioning. This has created a new line of business as we transition to become a SaaS company and move away from the commodity end of the market. Our vision is to become the leading SaaS connectivity company at both the platform and the device level and SMARTconnect enables us to implement the intelligence needed on the device.

On-device intelligence is fundamental to the success of IoT projects as a recent example clearly illustrates. One of our customers, PharmaWatch, which makes smart devices to track vaccine shipments, was subject to a 19-hour outage on the Rogers network in Canada last year. Typically, IoT devices would think they were still connected to the network because their connection to the nearest cell tower was still in place and therefore these devices would continue to try to connect to the network operator without success and so would be inactive.

For PharmaWatch, using SMARTconnect had enabled it to set a rule before the outage so that, if a device tries to connect three times in 30 minutes and fails, it would rotate to the next device-resident bootstrap and change operator. This rule solved the problem of the Rogers outage as PharmaWatch devices simply switched to another mobile network and continued to provide their service. This example really helps explain why the next big trend is device intelligence.

What does your IoT Readiness Index cover and how can IoT organisations utilise it?

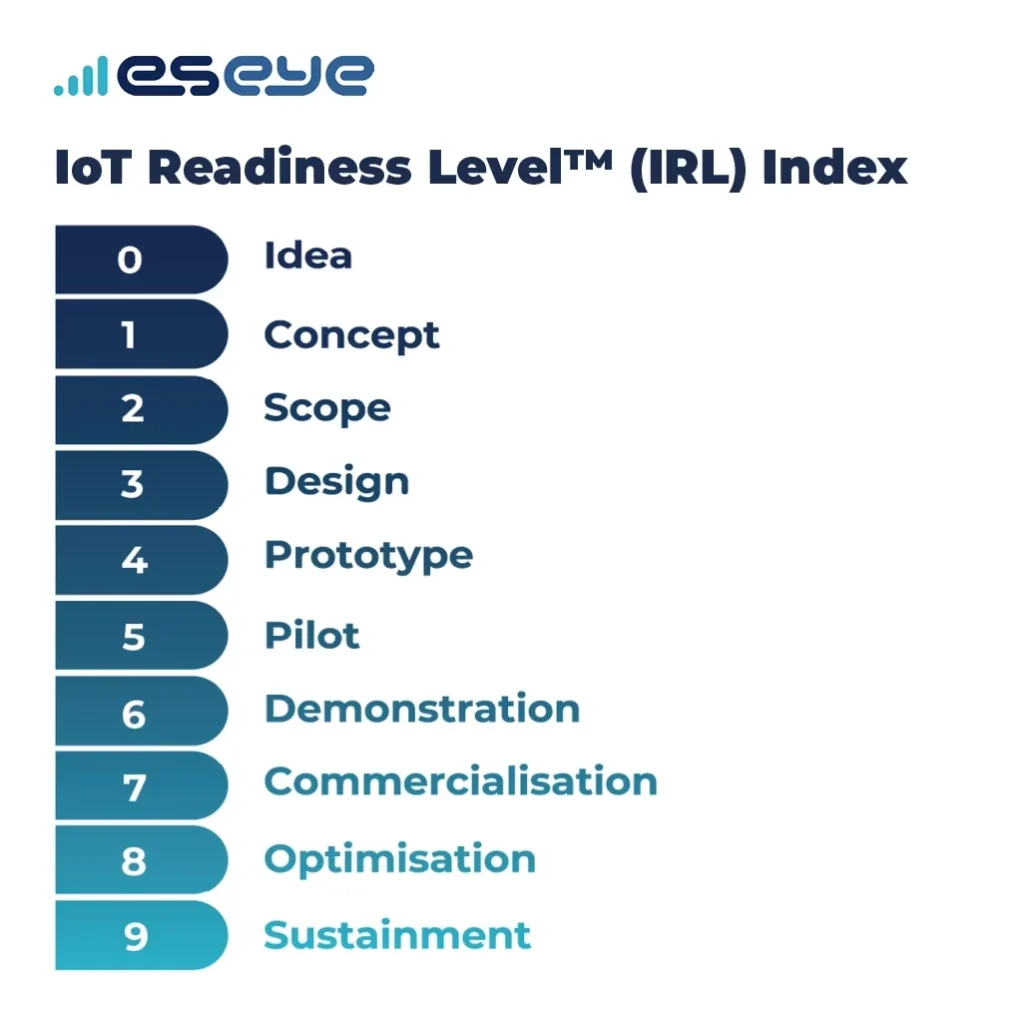

You can think about the implementation of a successful IoT project as a journey where stage one is the idea stage and stage nine is a fully sustainable IoT project. In between are multiple steps representing the work that is needed and, critically, what order they need to be carried out in. Examples include device design (stage three), proof of concept (PoC) (stage six) and defining the IoT commercial and operational model (stage seven).

When we engage with customers for the first time at Eseye most of them believe that they are ready for a PoC and ask for a quote for SIMs and data. But, because they have not focused on the device issues, there is a risk that, although a limited PoC will work, a full deployment won’t. When this happens, their only recourse is to go back to the device stage and start again. This can mean a six-to-nine-month delay in the project plus all the internal issues that creates. Over the last couple of years, we have been tracking how often this occurs and found that it was 90% – nine out of ten customers did not know how important device issues are. This explains why 80% of Eseye’s customers approach us after a failed IoT project. It’s as if people are selling cars but there are no driving schools!

Clearly there was a pressing need to solve this problem. To achieve this, Eseye has pioneered and launched an industry-first IoT Readiness Level Index that is derived from NASA’s Technology Readiness Level (TRL) framework.

Eseye’s IoT Readiness Level Index aims to measure the maturity of IoT readiness within a business, providing detailed information about the technical and operational readiness of an IoT device and project in the context of market best practices and similar projects within their industry vertical. It gives them a bearing as to where they are today, and how far they have to go to get to maturity. The IoT Readiness Index provides a very detailed assessment done in a formal workshop with the customer that assesses each stage on a scale of one-to-ten. It then reports back on where they are and what they need to do to progress. The industry needs a framework but there hasn’t been one in IoT until now and the market is in massive disruption because of this.

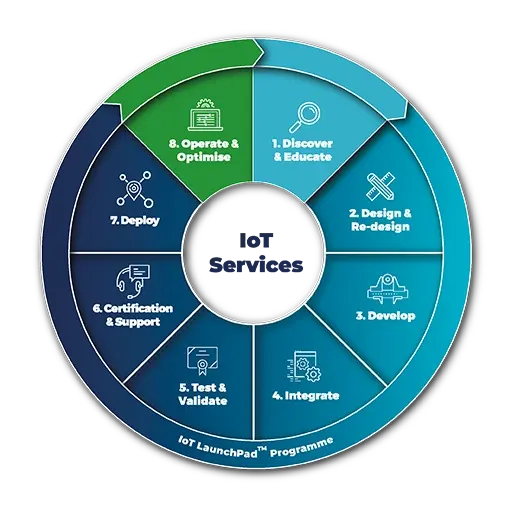

Once we have documented their personalised readiness assessment, we follow this up with a custom services proposal, which we call IoT LaunchPad, to help them optimise their IoT journey and maximise the chances of success. We’ve implemented over a 1,000 IoT projects so we’re bringing to the customer all of our accumulated knowledge, skills, best practices and expertise to their project. We measure how successful our customers are and it is reflected in our net promoter score (NPS) of +50 and customer satisfaction score of more than 98%.

How do you see this disruption playing out in the future?

Everyone in the value chain is readjusting their proposition and the big question is what their future role is going to be in the IoT landscape. There are two main models – value and volume. Volume is about that really low-cost offer to sell SIMs. It relies on very high volumes at very low cost, with a low-cost operating model. I expect most operators will continue to use their existing internal platforms to sell in this model to their existing markets. However, as operator agnostic eSIM-enabled global connectivity needs a different, value-based, solution I expect them to embrace new cloud native SaaS based solutions. In this way, mobile operators will participate in both value and volume models. But the challenge is that if you go up to value you need to have additional capabilities. How much do you know about hardware, about device intelligence, about firmware? Mobile network operators have not built these capabilities so they will have to partner with companies like Eseye. This creates new opportunities for us, the ability to sell new solutions for the operator and offer more choice for enterprises.

All of this is happening right now because of the technical disruption of eSIM. It will be reinforced by the introduction of operator agnostic iSIMs and will be further accelerated with the increasing adoption of multi-RAT in each device. It’s clear that a complete re-ordering of the IoT market is underway.

For us at Eseye, this is really exciting because it creates a need for a full IoT solutions portfolio consisting of multi-RAT global connectivity, a single platform, device-resident intelligent software and a comprehensive services framework capability. By combining all of these things together, we believe we can enable customers to deliver every IoT project right first time from device to deployment.

Nick Earle

Executive Chairman

LinkedInNick is the Executive Chairman at Eseye and believes in connectivity that ‘just works’; that makes people’s lives and jobs easier; connectivity that’s invisible. He’s a visionary business leader with a distinguished career in technology spanning more than 30 years, spanning large corporations and dynamic start-ups and oscillating between start-ups and global IT, tech and transportation companies.

Previously, Nick led organisations and cross-company transformation programs for two $50B global corporations; Cisco where he ran the Cloud and Managed Services business as well as their Worldwide Field Services function, and Hewlett Packard where he ran the global Enterprise Marketing function and the internet transformation strategy.

Demand the best IoT partner for your project. Find out why global leaders onboard our technical expertise, from device design to development.